Rumored Buzz on Clark Wealth Partners

Top Guidelines Of Clark Wealth Partners

Table of ContentsGetting My Clark Wealth Partners To WorkThe 8-Minute Rule for Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedClark Wealth Partners Fundamentals ExplainedThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutSome Known Incorrect Statements About Clark Wealth Partners Little Known Facts About Clark Wealth Partners.

The globe of money is a complex one., for example, just recently located that virtually two-thirds of Americans were unable to pass a standard, five-question monetary proficiency test that quizzed participants on topics such as rate of interest, debt, and various other relatively fundamental ideas.In enhancement to handling their existing customers, economic consultants will certainly typically invest a reasonable quantity of time weekly meeting with possible customers and marketing their solutions to keep and grow their service. For those taking into consideration coming to be an economic consultant, it is necessary to consider the average income and job security for those functioning in the area.

Programs in taxes, estate preparation, financial investments, and threat administration can be useful for students on this course. Relying on your one-of-a-kind career objectives, you may also need to earn specific licenses to accomplish certain customers' demands, such as dealing stocks, bonds, and insurance plan. It can additionally be handy to gain a certification such as a Licensed Financial Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

Clark Wealth Partners - Truths

What that looks like can be a number of things, and can differ depending on your age and phase of life. Some people stress that they need a particular quantity of cash to spend prior to they can obtain assist from a specialist (financial advisors illinois).

Clark Wealth Partners for Dummies

If you haven't had any type of experience with an economic advisor, here's what to anticipate: They'll begin by supplying a comprehensive assessment of where you stand with your properties, responsibilities and whether you're fulfilling standards compared to your peers for financial savings and retired life. They'll evaluate short- and long-term objectives. What's practical about this step is that it is individualized for you.

You're young and working complete time, have a car or more and there are trainee lendings to pay off. Below are some feasible ideas to help: Establish great savings routines, settle financial debt, set baseline goals. Settle trainee fundings. Depending upon your occupation, you might certify to have part of your institution car loan waived.

Some Of Clark Wealth Partners

You can talk about the next ideal time for follow-up. Financial consultants typically have different tiers of rates.

You're looking ahead to your retirement and aiding your children with higher education and learning expenses. An economic expert can offer advice for those circumstances and even more.

The Main Principles Of Clark Wealth Partners

Arrange normal check-ins with your planner to modify your strategy as needed. Balancing savings for retirement and university costs for your youngsters can be tricky.

Considering when you can retire and what post-retirement years could look like can produce issues concerning whether your retirement financial savings remain in line with your post-work strategies, or if you have saved sufficient to leave a tradition. Assist your economic professional comprehend your approach to cash. If you are extra conservative with saving (and potential loss), their tips ought to react to your worries and worries.

Our Clark Wealth Partners PDFs

Preparing for wellness treatment is one of the huge unknowns in retired life, and an economic expert can detail options and recommend whether added insurance as defense may be useful. Before you start, attempt to get comfortable with the concept of sharing your whole financial picture with a professional.

Giving your expert a full photo can help them develop a plan that's prioritized to all components of your economic standing, especially as you're rapid approaching your post-work years. If your funds are simple and you have a love for doing it yourself, you may be great on your very own.

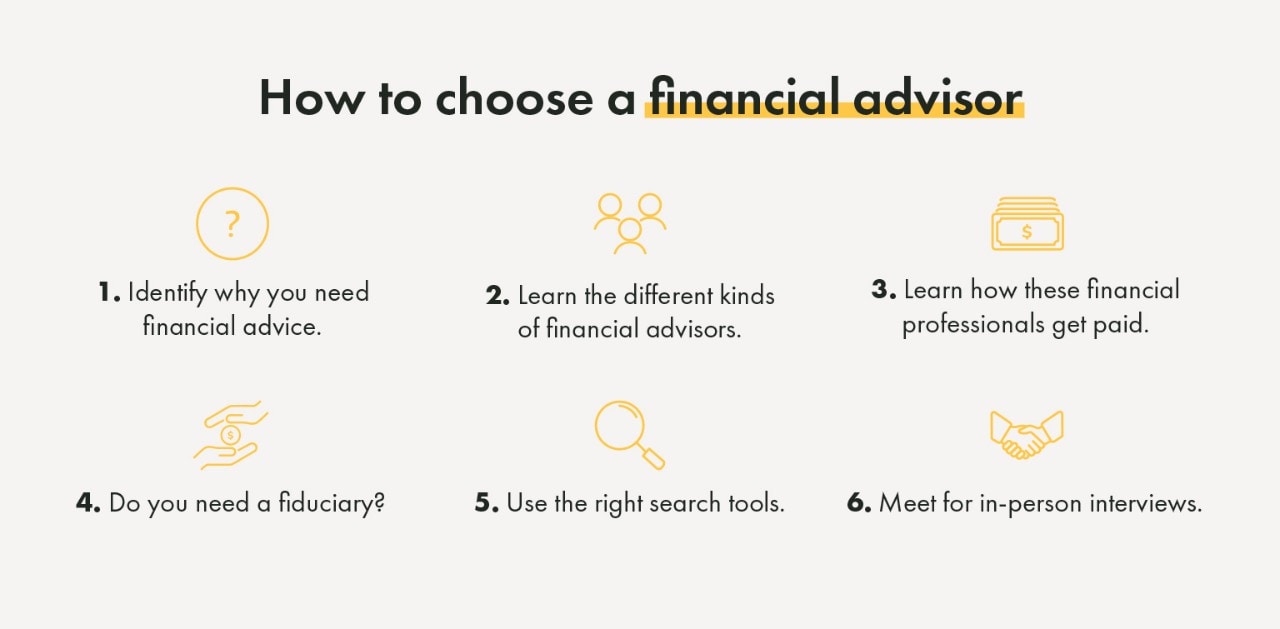

A financial expert is not just for the super-rich; any person facing significant life shifts, nearing retired life, or feeling bewildered by monetary choices might take advantage of professional guidance. This article explores the function of economic experts, when you may require to seek advice from one, and crucial considerations for picking - https://moz.com/community/q/user/clrkwlthprtnr. A monetary consultant is a skilled specialist that aids clients handle their funds and make informed decisions that straighten with their life goals

Little Known Questions About Clark Wealth Partners.

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)

Payment designs also vary. Fee-only experts bill a flat fee, hourly rate, or a percentage of properties under administration, which often tends to minimize prospective problems of passion. On the other hand, commission-based experts make earnings through the monetary products they sell, which may influence their referrals. Whether it is marital relationship, separation, the birth of a kid, career changes, or the loss of a liked one, these occasions have unique economic ramifications, usually needing prompt decisions that can have long-term effects.